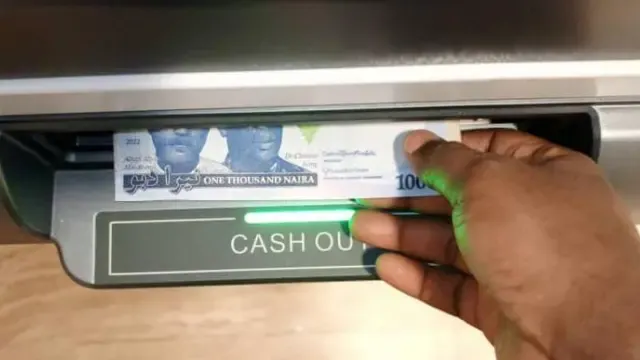

The ongoing cash scarcity in Nigeria is severely impacting businesses, particularly Micro, Small, and Medium Enterprises (MSMEs), according to the Organized Private Sector (OPS). The OPS has joined calls for the Central Bank of Nigeria (CBN) to address the crisis, warning of potential economic collapse if the situation persists.

The OPS contends that while the CBN’s intentions may be to modernize the financial system, the current policies have inadvertently stifled business operations across the country. “Nigeria’s economy is not yet developed enough for a predominantly cashless system,” stated Segun Kuti-George, National Vice President of the Nigerian Association of Small-Scale Industrialists.

He emphasized that a significant portion of the population still relies heavily on cash for daily transactions, and the current withdrawal limits are impractical for businesses and individuals.

Dr. Femi Egbesola, National President of the Association of Small Business Owners of Nigeria, echoed these concerns, highlighting the devastating impact on businesses that rely on small cash transactions. He warned that the scarcity could lead to the extinction of a substantial portion of the MSME sector.

Dr. Muda Yusuf, Director of the Centre for Promotion of Private Enterprise (CPPE), pointed to several factors contributing to the crisis, including low financial inclusion, limited trust in electronic payment systems, and the rise of Point of Sale (POS) operators who compete with banks for cash.

Meanwhile, the CBN is taking steps to address the issue, imposing fines on banks found guilty of facilitating the illegal flow of mint naira notes to hawkers. The bank also issued warnings against cash hoarding and diversion, while intensifying monitoring efforts.

However, experts argue that a multi-faceted approach is necessary to resolve the crisis, including improving financial inclusion, enhancing financial literacy, and restoring trust in electronic payment systems.

Follow us on Instagram.

https://www.instagram.com/businessnewsng?igsh=ZXpweTdjOGF1ZXdu