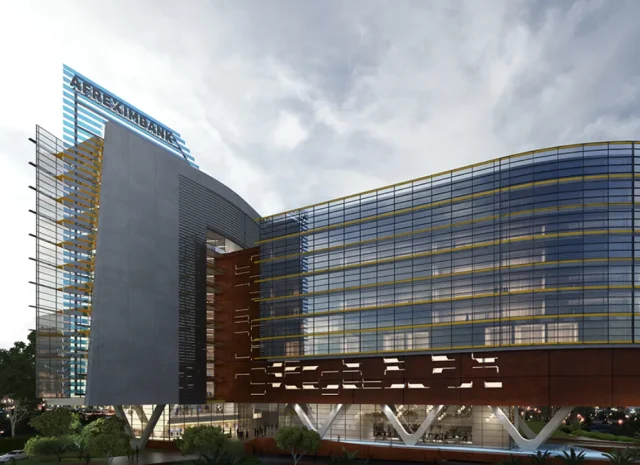

Artificial intelligence is emerging as a transformative force in African trade, not only by enhancing efficiency but also by strengthening financial integrity, curbing illicit flows, and unlocking new market access. In a major step toward modernizing the continent’s compliance infrastructure, the African Export-Import Bank (Afreximbank) will co-host the 2025 Afreximbank Compliance Forum (ACF2025) with the National Bank of Rwanda (BNR) from November 12 to 14 in Kigali. Themed “Better Compliance – Better Trade: Embracing AI to Promote and Secure Trade Through a Modern AML/CFT Compliance Framework,” the event will spotlight how AI in African trade compliance is reshaping risk assessment, fraud detection, and cross-border transaction monitoring.

The forum arrives at a pivotal moment for Africa’s integration into global markets, where robust anti-money laundering and countering the financing of terrorism (AML/CFT) frameworks are increasingly tied to trade finance access and investor confidence. Dr. George Elombi, Executive Vice-President for Governance, Legal, and Corporate Services at Afreximbank and its incoming President, emphasized that AI is no longer a futuristic concept but an operational reality. “Artificial Intelligence is already shaping the present of compliance,” he said. “What was once seen as regulatory burden is now a strategic enabler of trade and economic growth.” He added that strong compliance systems foster trust, ensure legal alignment, and create fairer competition—key ingredients for expanding intra-African and international trade.

Hon. Soraya M. Hakuziyaremye, Governor of the National Bank of Rwanda, welcomed the partnership, describing compliance as foundational to financial stability and sustainable development. “We view compliance as a catalyst for trust and transparency,” she said. “By embracing innovations like artificial intelligence, we are reinforcing the integrity of our financial system, boosting investor confidence, and positioning Rwanda as a reliable gateway for global trade.” Hosting ACF2025, she noted, reflects both national leadership and continental ambition to leverage technology in building resilient, future-ready economies.

Expected to draw central bankers, regulators, commercial banks, fintechs, legal experts, auditors, and financial intelligence units from across Africa and beyond, the forum will examine critical developments in digital compliance. Discussions will include the role of AI in automating customer due diligence, detecting trade-based money laundering (TBML), improving correspondent banking relationships, and enabling real-time surveillance of transactions. Case studies will highlight successful implementations of AI in client onboarding and risk monitoring, while insights from the Financial Action Task Force (FATF) will provide a global perspective on digital transformation in financial regulation.

Particular attention will be given to lessons from African nations that have successfully exited the FATF grey list—a status that often restricts access to international finance—demonstrating how targeted reforms and technological adoption can restore global credibility. As African countries deepen participation in the African Continental Free Trade Area (AfCFTA), ensuring secure, transparent trade corridors has become essential.

ACF2025 builds on Afreximbank’s growing investment in AI-powered compliance platforms designed to streamline client onboarding, monitor risks in real time, and safeguard transaction integrity. Last year’s forum in Dakar saw attendance more than double, drawing delegates from 36 countries and 25 expert speakers, underscoring rising demand for knowledge-sharing and collaboration in this space.

By bringing together regulators, financial institutions, and technology providers, the 2025 event aims to equip stakeholders with practical tools, policy guidance, and strategic partnerships to balance innovation with governance. It also reinforces a broader vision: that Africa’s trade potential cannot be fully realized without secure, intelligent, and adaptive compliance systems.

As artificial intelligence redefines what is possible in financial oversight, initiatives like ACF2025 signal a shift—from reactive enforcement to proactive protection—ensuring that Africa’s trade expansion is not only rapid but responsible, inclusive, and globally trusted.

Registration for the Afreximbank Compliance Forum 2025 is open at acf2025.com .

Follow us on Instagram.

https://www.instagram.com/businessnewsng?igsh=ZXpweTdjOGF1ZXdu